Basic policy

Enhancement of corporate governance structure

FY2023

To improve the environment for exercising voting rights at the General Meeting of Shareholders, we introduced the "electronic voting process. "The Board of Directors set themes focused on the company’s management capital and held discussions based on those themes.

FY2024

To deepen discussions in the Board of Directors, we selected specific discussion topics and secured sufficient time for thorough discussions.

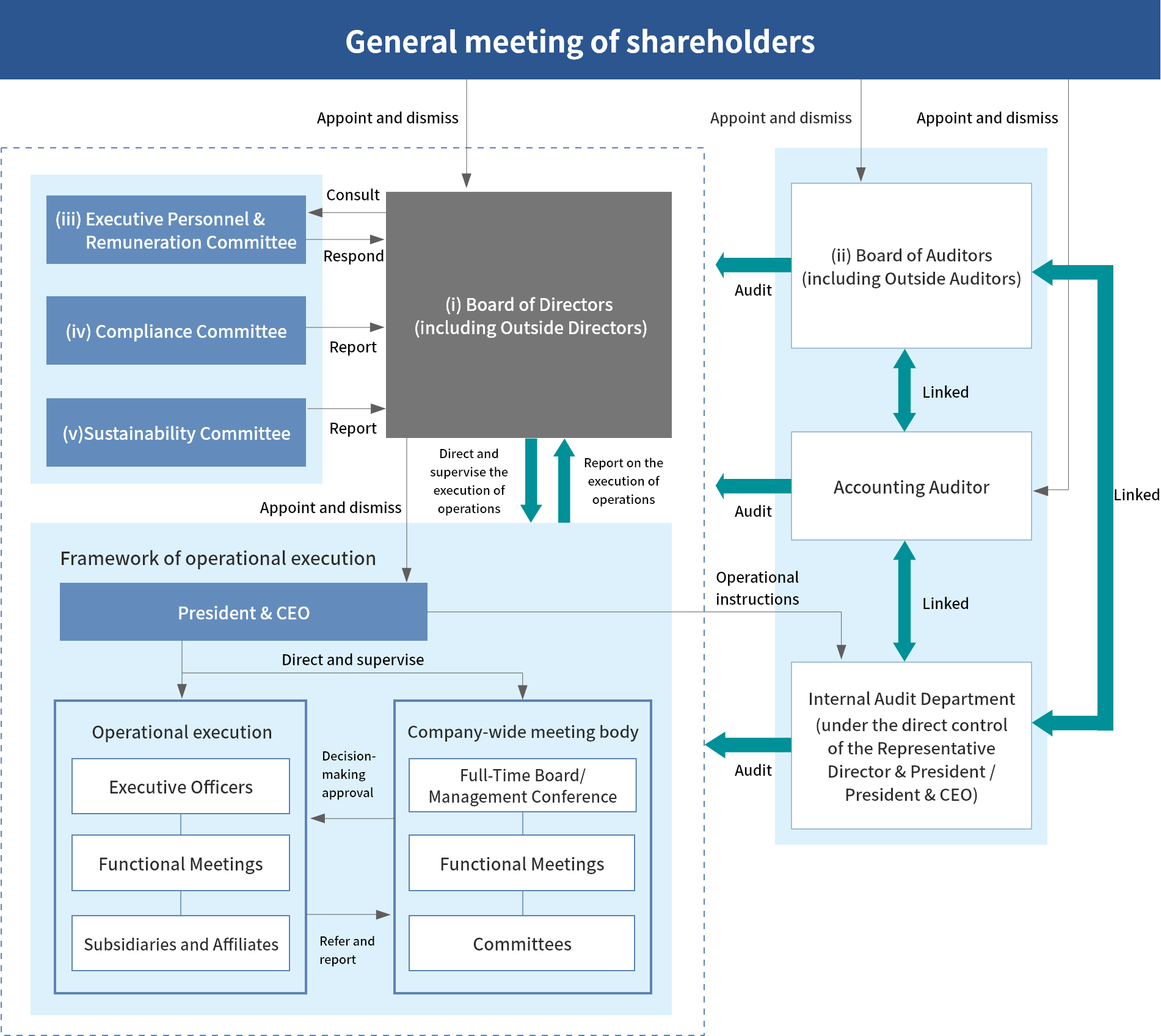

Advisory/Executive oversight functions of the board of directors

(i)Board of directors

In principle, the meeting is held once a month and consists of 5 directors (including 2 outside directors) and 5 corporate auditors (including 2 outside corporate auditors)

Decisions on matters stipulated by laws and the Articles of Incorporation, as well as important management matters, supervision of business execution, and discussions on mid- to long-term management issues and future strategies

(ii)Board of auditors

In principle, the meeting is held once a month and consists of 5 corporate auditors (including 2 outside corporate auditors)

The audit activities are carried out in accordance with the audit policy and plan established by the Board of Auditors, and the management soundness of the Taiho Group and the audit and supervision of directors are implemented

(iii)Executive personnel & remuneration committee (newly established in January 2021)

In principle, the meeting is held at least once a year and consists of 3 directors (including 2 outside directors)

Matters related to the appointment and remuneration of directors, etc. are discussed and reported to the Board of Directors for consultation (director structure, skill matrix, remuneration by position, individual remuneration amounts, etc.)

(iv)Compliance committee

In principle, the meeting is held at least once a year and consists of 5 directors (including 2 outside directors), 1 corporate auditor, 4 general managers and 1 general counsel

Reporting and discussion of the Taiho Group's internal control and compliance status, compliance education, etc.

(v)Sustainability committee

In principle, the meeting is held at least once a year and consists of 5 directors (including 2 outside directors)

Identify important issues (materialities) to be solved for the realization of a sustainable society, including social and environmental issues, and report to the Board of Directors on efforts to address these issues through the business (roadmap to achieve carbon neutrality, etc.)

Board of directors

Efforts to revitalize the board of directors

Our company comprehensively reviews the structure of the Board of Directors from the perspective of timely and appropriate decision-making and optimal personnel allocation. The agenda items for the Board of Directors are explained using concise and clear materials, and the board is operated in a way that ensures both immediacy and interactivity, including online participation and written deliberations. As a result, almost all agenda items receive comments from external directors and external auditors.Skill matrix

As the environment surrounding our company undergoes significant changes, it is essential for us to strengthen the business foundation of the Taiho Group, achieve sustainable growth, and enhance corporate value. To enable the Board of Directors to fulfill this role, we have organized the necessary experience and expertise into a skill matrix.Effectiveness of the board of directors

To enhance the effectiveness of the Board of Directors, we conduct annual evaluations and analyses of its effectiveness as outlined below.<Evaluation and analysis>

In March 2024, we conducted a survey for all directors and auditors regarding the effectiveness and operational methods of the Board of Directors. The evaluation results were reported at the Board of Directors meeting in May of the same year.

<Summary of evaluation results>

The evaluation concluded that the Board of Directors is generally functioning appropriately, and its effectiveness is ensured. However, the following issues were identified as areas for improvement:

- Securing more time for discussions

- Selecting specific discussion themes, including management risks

- Continuing business briefings and deepening communication

- Strengthening the governance system of both domestic and overseas group companies

Policy for determining executive compensation

<Basic policy>

Our executive compensation system is designed to enhance motivation for sustainable improvement in corporate value and to be aligned with shareholder interests. The compensation for individual directors is determined at an appropriate level based on their respective responsibilities. Specifically, it consists of a "base salary" as fixed compensation and a "bonus" as performance-linked compensation.

<Fixed compensation>(Base salary)

The base salary is determined comprehensively by taking into account the executive's position, responsibilities, as well as external benchmarks, the company’s performance, and employee salary levels.

<Performance-linked compensation>(Bonus)

To increase awareness of improving performance, the bonus is a cash payment linked to the performance indicator of consolidated operating profit. The amount is calculated based on the increase or decrease in consolidated operating profit compared to the previous fiscal year, and is paid at a specified time each year.of Directors.

Governance