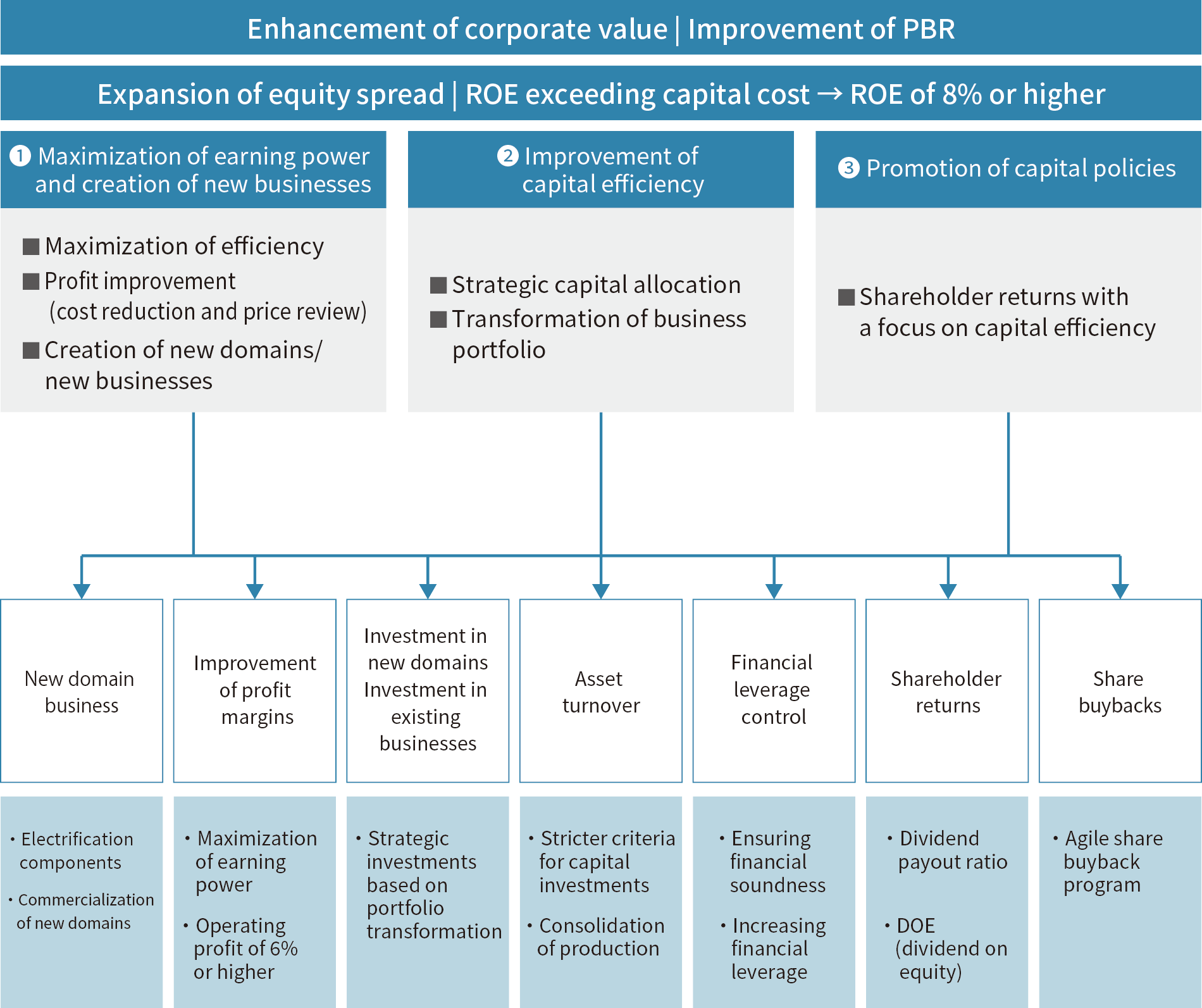

Basic approach

![[Enhancement of corporate value] [Maximization of earning power] [Promotion of capital Policies] [Improvement of capital Efficiency]](/assets/media/2024/10/img-shareholder-02_en.jpg)

Financial management

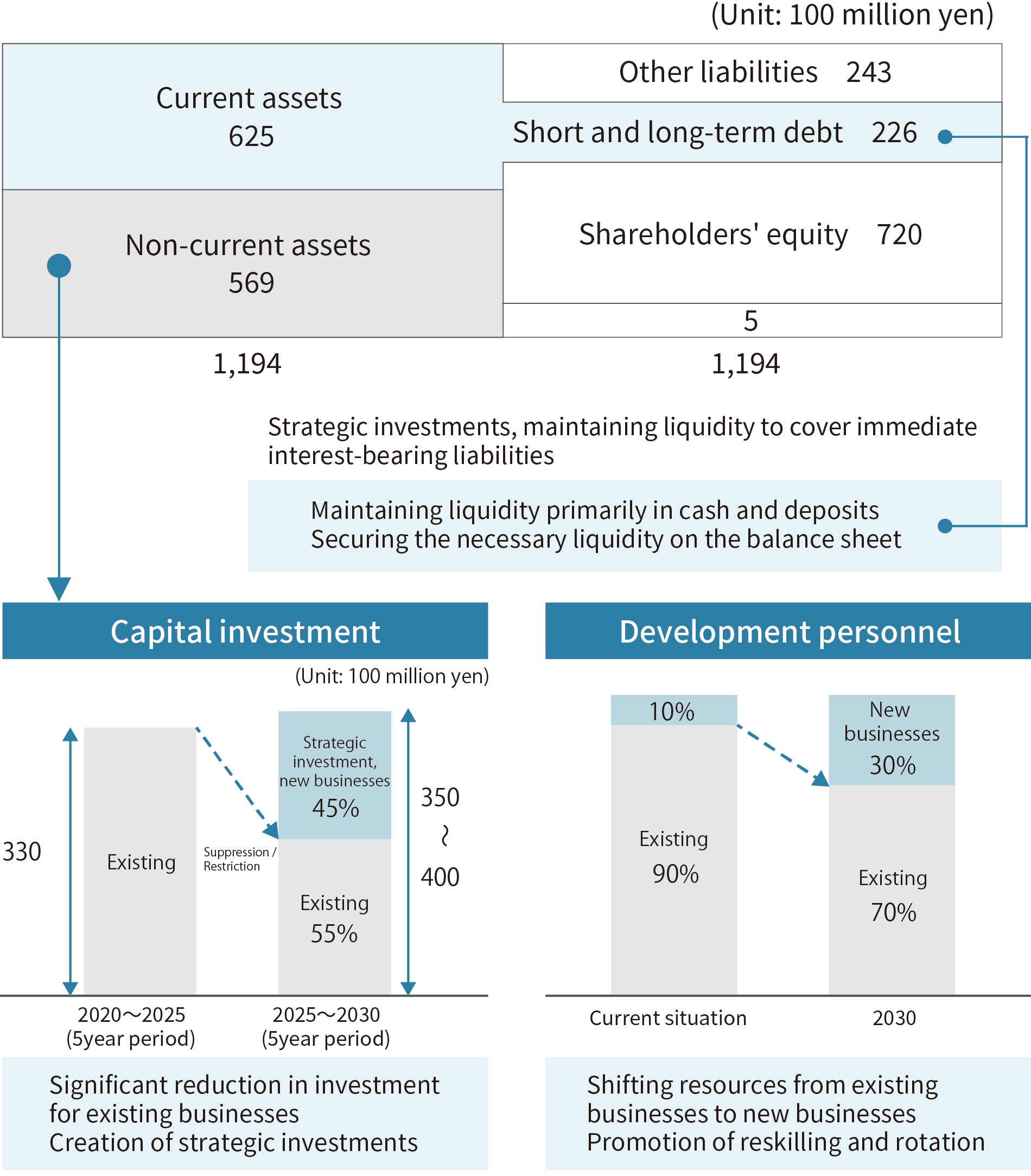

Balance sheet (As of the end of March 2024)

Financial soundness

In addition to focusing on improving indicators such as operating profit margin, ROE, and ROIC, we place importance on financial health indicators such as the D/E ratio (debt to equity ratio) to maintain sound finances.Approach to strategic investments

From the perspective of asset and capital efficiency, we will continue to promote efficient business operations. This year, with a view toward 2030, we have set the direction for mid- to long-term investments and resource allocation. In terms of resource allocation, we plan to reduce capital investment in existing businesses by 45% and focus on creating strategic investments, including C/N, as well as investments in new businesses. For development personnel, we will promote reskilling and rotation, shifting resources towards new businesses.Cash flow and cash allocation

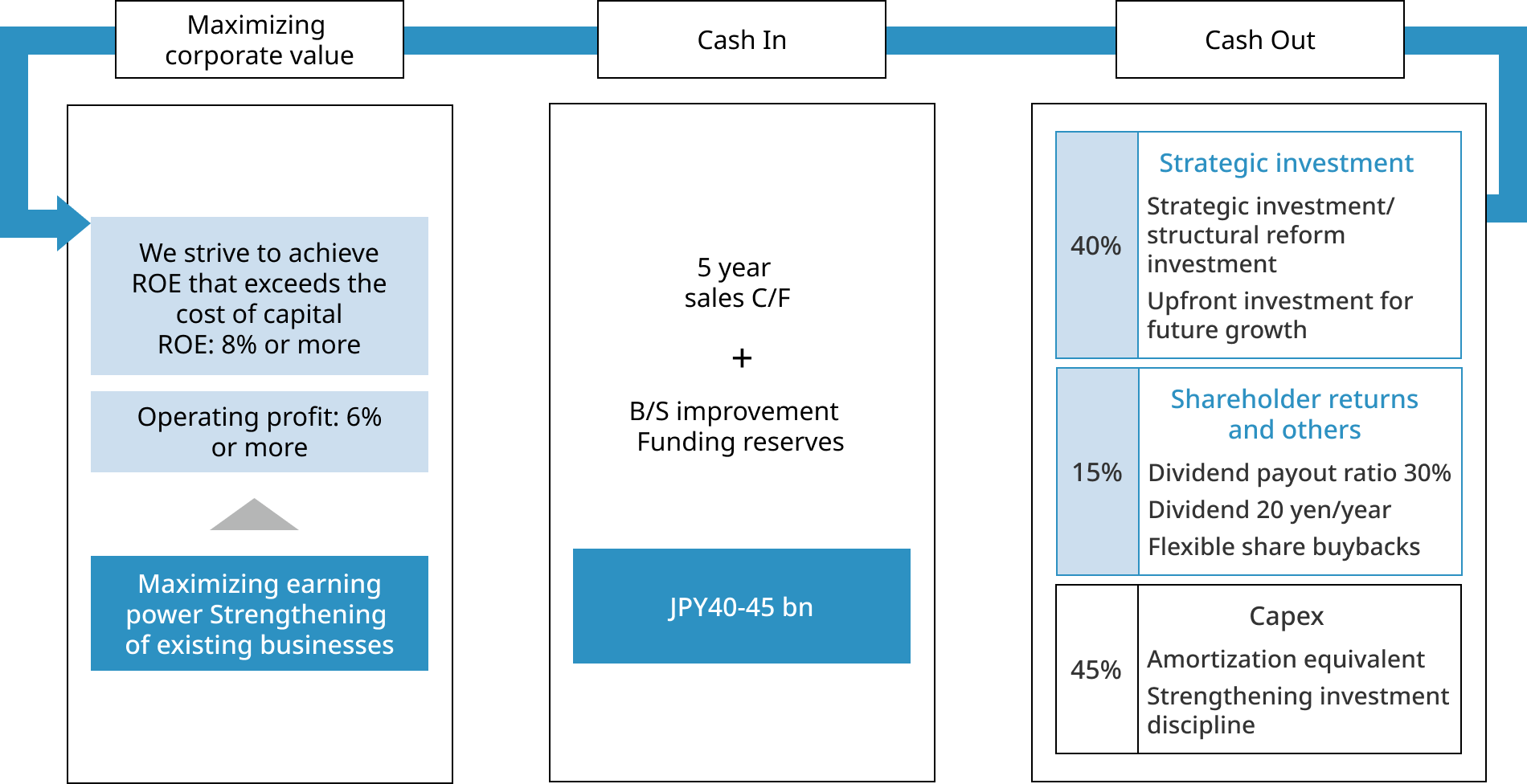

Medium to long-term plan

Shareholder returns with a focus on capital efficiency

Activities for enhancing corporate value

Main initiatives and achievements

- Automotive engineering exposition 2024 (May)

- Business strategy briefing (May)

- Annual general meeting of shareholders (June)

- Individual meetings with institutional investors and securities analysts (Ongoing)